Guide to Adulting: Saving and budgeting money

PHOTO Bree Soule

September 27, 2021

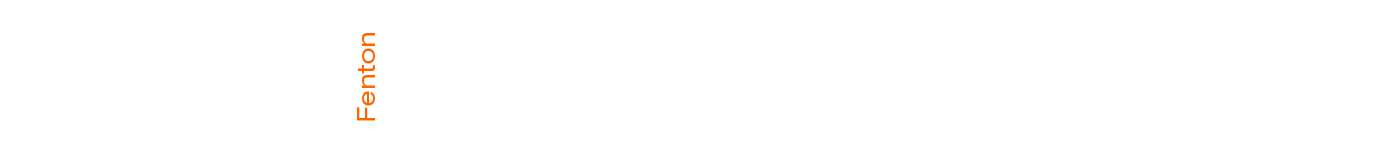

Saving and budgeting is of high importance and, as American personal finance personality Dave Ramsey likes to say, “If you save, you win.” Whether it’s eating out, purchasing gifts or preparing for a large expense coming up, budgeting money helps to prevent poor spending habits and ensure you have money for certain expenses.

“Having money puts you more in control in almost every area of life,” Ramsey said as stated in an article on Ramsey Solutions, “and when you have that control, you make smarter decisions and have less stress and more peace and contentment. All because you had the discipline to stock money away.”

The three major parts of saving money include the following: saving for an emergency fund, purchases and investing. A brokerage account— which is an investment account used to buy and sell investments such as stocks— can be opened at the age of 18, until then, becoming familiar with the stock market may be helpful for the future.

First up is an emergency fund. This is needed for high school students as well as adults. America Saves believes an emergency fund is a necessity, not a recommendation. This is helpful to have for expenses such as your car breaking down and you need a repair or if you become ill and need to purchase medical supplies. This fund is for unexpected financial hardships and will make sure you are prepared for emergencies.

For a high school student, America Saves recommends having $500 saved for an emergency fund. For an adult it is recommended to have three to six months worth of expenses saved.

Spending is a large portion of peoples’ paychecks; therefore, it is also a large part of a saving and budgeting plan. To begin saving money, the first step is figuring out how much money you spend monthly. The Bank of America offers their advice on how to begin: “Look for a free spending tracker to help you get started. Choosing a digital program or app can help automate some of this work.”

According to Nerd Wallet, you should “automate as much as possible so the money you’ve allocated for a specific purpose gets there with minimal effort on your part. An accountability partner or online support group can help, so that you’re held accountable for choices that blow the budget.” They also recommend saving 10 to 15 percent of your income.

One habit numerous high school students engage in that hinders their ability to save money is eating out. If you bought one Starbucks drink every day before school for a month, that would be approximately $135 spent on Starbucks alone. Reducing the amount of time spent eating out would greatly reduce monthly expenses as they add up overtime.

Following these steps will help to save money each month and ultimately increase the amount of money you have.