5 tips for being more fiscally responsible as a high schooler

November 4, 2019

“I don’t have any money” is a phrase often uttered by high schoolers; poor money management skills could be to blame. Practicing money management is a valuable skill for high schoolers to learn in order to set a precedent for their futures. See below for five money management tips for high school students.

Set a savings goal

Especially in the case of teenagers, having a specific goal to save for helps motivate you to spend less and save more. A nameless savings account isn’t as appealing as a college fund or vehicle savings account. Set a specific goal to save for in order to maximize savings.

Make consistent “payments”

Most high schoolers don’t have very many regular payments, like bills. By treating your savings account as a bill to be paid, you will get practice making those payments, like in the adult world, and grow your savings while you’re at it.

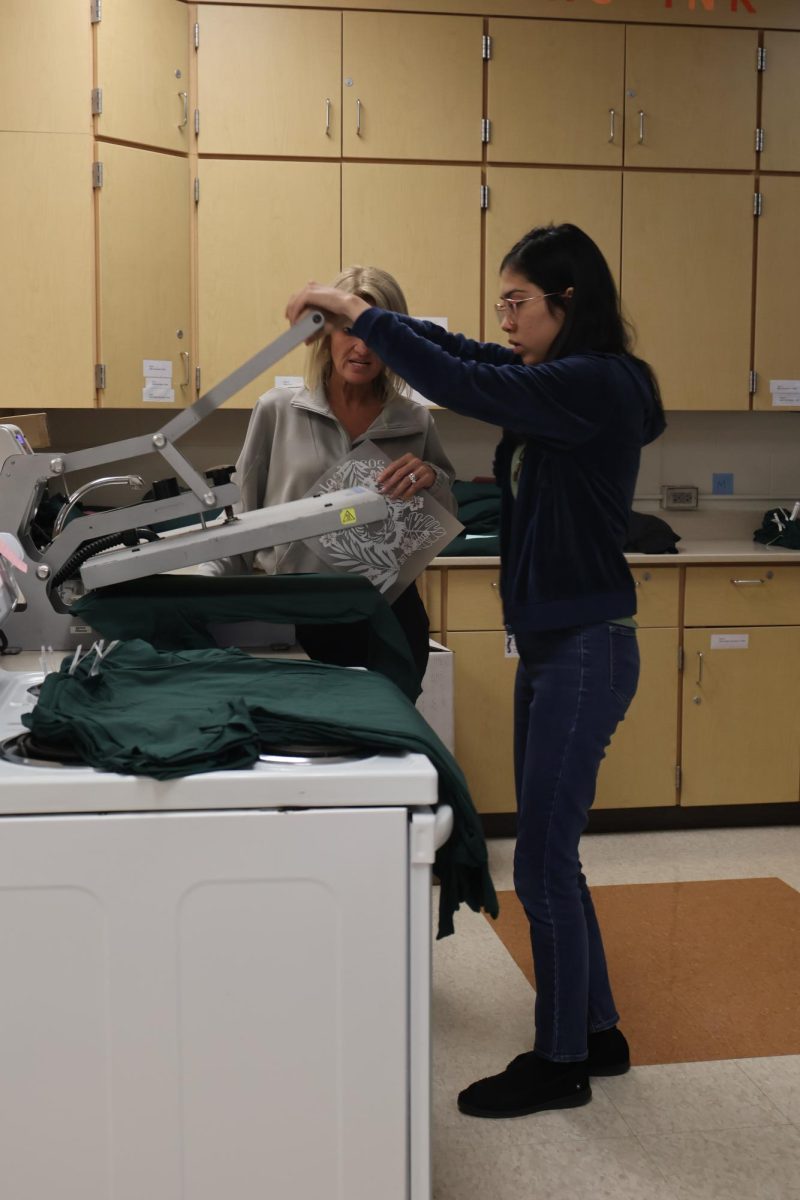

Create a balance

Let’s face it— saving every single penny you earn is pretty unrealistic. Instead of setting unrealistic goals, decide how much you need to spend and how much you need to save. For example, if you’re a waitress, put your checks in savings and keep your tips to cover expenses you might have. Creating a balance between spending and saving is more manageable than a spending freeze.

Budget

Budgeting can be a valuable skill for adults and children alike, so getting practice early sets teens up for success. Set aside a certain amount of money each week for gas, shopping, food or any other expenses you may have.

Make your money work for you

Money isn’t growing if it’s sitting in a piggy bank under your bed— put the money you earn/save in a savings account so that you can collect interest on it, or invest it if you feel comfortable doing so and are of age.